How Your Kids Can Derail Your Retirement (Unless You Plan for It) post

Learn how adult children can impact your retirement and discover actionable strategies to protect your financial future. Set healthy boundaries, plan wisely, and enjoy peace of mind in retirement.

Mike Upland

6/8/20253 min read

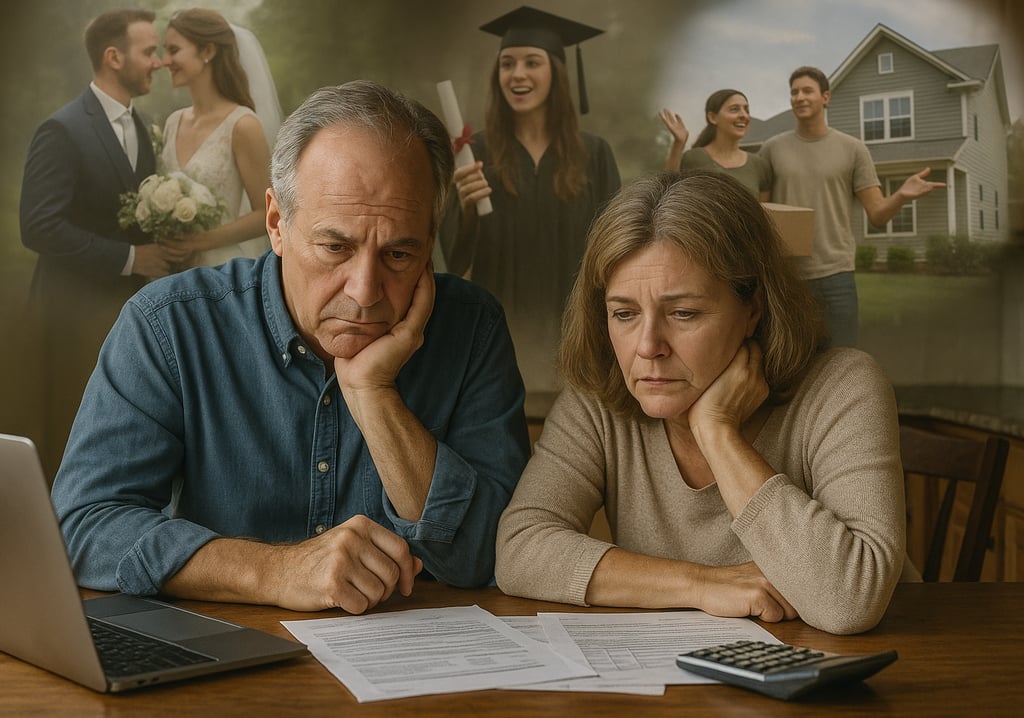

Introduction: The Silent Threat to Retirement Security

For many early retirees, the financial needs of adult children are a surprisingly potent force that can jeopardize a well-laid retirement plan. A 2025 CNBC report revealed that half of U.S. parents with adult children are giving regular financial support, averaging $1,474 per month—nearly $18,000 annually. Whether you're already retired or planning for it, ignoring this dynamic could mean sacrificing your long-term security.

The Hidden Costs of Parenting Grown-Up Children

Weddings: A Beautiful but Costly Tradition

According to Zola, the average U.S. wedding in 2025 costs $36,000. Many parents feel compelled to help, but without a budget in place, this generosity can quickly drain your savings.

Tuition, Loans, and Education Expenses

Covering college or graduate school tuition for your children is noble, but it might not be financially sustainable—especially if you no longer have an active income.

Everyday and Emergency Support

From helping with a down payment on a house to assisting during emergencies, the list of ways parents financially support adult children is endless. These expenses can silently chip away at your retirement funds.

Financial Planning Pitfalls to Avoid

Giving Without a Strategic Plan

Generosity is commendable, but doing it without a clear plan can backfire. Make sure each financial gift or loan aligns with your long-term goals.

Co-Signing Loans: A Risky Proposition

Co-signing a loan can put your own credit and financial future at risk, especially if your child fails to meet the repayment terms.

Neglecting Your Own Emergency Fund

Even in retirement, having a cash cushion is essential. It shields you from needing to liquidate investments during market downturns or incurring debt to handle unexpected expenses.

The Compounding Impact of Generosity

Opportunity Costs of Early Withdrawals

Every dollar you give away is a dollar that can no longer grow. Over time, this lost compounding can significantly reduce the longevity of your retirement portfolio.

Balancing Taxes and Subsidies

Especially for early retirees using ACA marketplace health plans, helping your kids financially could unintentionally raise your Modified Adjusted Gross Income (MAGI), reducing your health subsidies.

The Hard Truth: You Can't Always Recover

You're no longer in your prime working years. A financial setback now could force you back into the workforce—a daunting prospect in your 60s or 70s.

How to Incorporate Family Support Into Your Retirement Plan

Add a “Family Support” Line Item

Incorporate expected contributions into your retirement budget to ensure you're not blindsided by generosity.

Revisit Your Estate Plan

Decide now if you want to give while living or as part of an inheritance or both. Clarify amounts to maintain control and set expectations.

Understand the Gift vs. Loan Distinction

Be clear with your children about whether your support is a gift or a loan. If it's a loan, formalize terms and timelines to avoid misunderstandings.

Setting Boundaries with Love and Clarity

Communicate with Compassion

Use honest, empathetic language. For example: “We love you and want to help, but we must also secure our retirement. Let’s talk about what’s possible.”

Define and Stick to Limits

Decide in advance what you can afford to give and don’t exceed that. For instance: “We’ve budgeted $5,000 to help. Beyond that, we can’t do more.”

Model Healthy Financial Habits

By setting and respecting financial boundaries, you show your children how to manage money responsibly, preparing them for their own financial independence.

Conclusion: Prioritize Your Peace and Independence

Planning to help your children shouldn't come at the cost of your retirement. By building their potential needs into your financial plan and setting respectful boundaries, you protect not just your future but theirs too. Remember, your children have the advantage of time and earning potential. You, however, have earned your peace.

FAQs

1. Should I include my kids' potential needs in my retirement budget?

Yes, if you anticipate supporting them, include it as a line item to avoid unexpected financial strain.

2. How do I talk to my adult children about financial boundaries?

Approach the conversation with love and clarity. Be transparent about your limits and emphasize your commitment to financial stability.

3. Can supporting my children affect my ACA subsidies?

Yes, any financial gifts or withdrawals from retirement accounts could increase your MAGI and reduce ACA health insurance subsidies.

4. Is it okay to say no to my adult kids' financial requests?

Absolutely. Saying no is often necessary to protect your own future and should be seen as a responsible decision, not a lack of generosity.

5. What are some safe ways to help my kids financially in retirement?

Plan ahead, clarify terms, avoid co-signing loans, and ensure any support doesn’t jeopardize your financial well-being.

Watch the video:

Mike Upland

Helping you achieve your early retirement goals and thriving in retirement.

© 2025. All rights reserved. Privacy Policy / Terms of Use / Disclaimer

The content on this website is for informational and educational purposes only, based on my personal experiences and research. Before making significant financial decisions, consult with a certified financial planner, tax professional, or other qualified expert.